this article explains the meaning of the term " Leverage ", how to use it in forex trading,and the benefits of using large and small Leverage.

|

| What is Leverage |

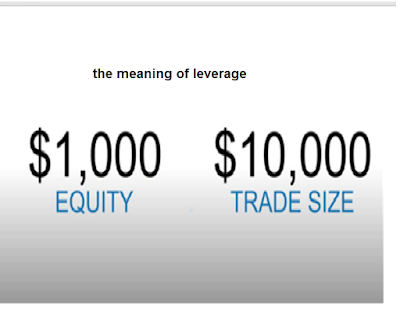

Leverage can be defined as a financial instrument that enables anyone to enhance the marketplace exposure to a spot in which is greater than the actual investment. For instance, a speculator moves very long 10000 products with the USD/JPY, using $1, 000 us dollars connected with a money of their bank account.

This USD/JPY business is the same as managing $10, 000. Since the business is actually 10 times larger than the actual money within the trader’s bank account, the actual bank account is actually reportedly leveraged 10 times or perhaps 10: 1.

if the speculator bought 20, 000 units of the USD/JPY, which is the same as $20, 000, their account would've been leveraged 20: 1.

Leverage allows a person to handle larger deal sizes. Traders use this tool in an effort to magnify their own returns.

It’s essential to stress, that losses will also be magnified while leverage is used. Therefore, you should understand that leverage should be controlled.

many companies offer flexible control to it is clients. You possibly can trade with no leverage in any way, or you can trade using a significant level of leverage.